Asian stocks rose, with the regional benchmark index heading for its first advance in three days, as energy and raw-material producers gained after oil surged. Shares in Tokyo fell after the yen strengthened, with the Topix index erasing its rally from the Bank of Japan’s latest stimulus.

The MSCI Asia Pacific Index climbed 0.6 percent to 120.58 as of 4:01 p.m. in Hong Kong, after falling as much as 0.1 percent. The Standard & Poor’s 500 Index rose on Wednesday as commodity producers rallied with oil. The yen traded at 117.69 per dollar after strengthening 1.7 percent on Wednesday, the most since August, as weak U.S. services data fueled anxiety America’s economy isn’t immune to weakness elsewhere.

“The selloff in the U.S. dollar is supportive of commodities,” Scott Schuberg, chief executive officer at Rivkin Securities, a brokerage in Sydney, said by phone. “We’ve been trading under conditions that’s been fairly gloomy. The outlook for China has been gloomy for years now. I don’t really think that there’s too much negative sentiment that could be piled on to this market. Investors should start buying slowly.”

Crude futures rebounded as the falling U.S. dollar countered any concerns in the market over a steep gain in U.S. crude inventories to more than 500 million barrels for the first time since 1930. West Texas Intermediate futures jumped as much as 2.1 percent on Thursday after surging 8 percent on Wednesday.

BHP Jumps

Australia’s S&P/ASX 200 Index gained 2.1 percent, the biggest advance since Dec. 16. BHP Billiton Ltd., the world’s largest mining company, climbed 8.3 percent, most since June 2009. Zinc led a rally in industrial metals in Asia after the dollar slumped, making commodities priced in the U.S. currency more attractive to investors.

South32 Ltd., the world’s largest manganese producer, surged 14 percent in Sydney after announcing it’s slashing jobs and cutting output as part of cost-control measures that Deutsche Bank AG estimates could generate $1 billion in annual savings.

China’s Shanghai Composite Index climbed 1.5 percent as the central bank stepped up efforts to ease a cash shortage before mainland markets close for the lunar new year holidays next week. The People’s Bank of China will inject 80 billion yuan ($12.2 billion) into the banking system using 14-day reverse repurchase agreements Thursday, according to two traders at primary dealers required to bid at the auctions.

Bolster Sentiment

“PBOC is trying to bolster sentiment before the holidays with a rebound in oil and commodity prices giving a helping hand,” said Ronald Wan, chief executive at Partners Capital International in Hong Kong. “It is too early to celebrate though, as underlying concerns over the economy have not abated and volatility in commodity prices remain.”

South Korea’s Kospi index rose 1.4 percent. Singapore’s Straits Times Index added 0.3 percent. Hong Kong’s Hang Seng Index advanced 1 percent. New Zealand’s benchmark gauge increased 0.1 percent.

Japan’s Topix fell 1.2 percent. The measure dropped below its closing level on Jan. 28, the day before the central bank surprised investors by saying it would adopt negative interest rates. The stronger yen dragged Japanese exporters lower, with Toyota Motor Corp. sliding 2.1 percent.

Sharp Soars

Sharp Corp. surged as much as 26 percent after public broadcaster NHK said the struggling display maker’s board decided to give Taiwan’s Foxconn Technology Group preferred bidding rights to take over the company. Sharp said it’s not the source of the report. The stock pared its advance to 17 percent.

Hitachi Ltd. plunged 7.8 percent after slashing its full-year profit forecast as Chinese growth slowed and oil prices plummeted. Panasonic Corp. tumbled 8.7 percent after lowering its operating-profit outlook.

E-mini futures on the S&P 500 advanced 0.4 percent. The U.S. equity benchmark index finished 0.5 percent higher on Wednesday, erasing an earlier drop of 1.6 percent as energy and raw-material producers advanced. A report showed service industries expanded in January at the slowest pace in nearly two years, raising the risk that persistent weakness in manufacturing is starting to spread to the rest of the U.S. economy.

Analysts are projecting oil prices will climb more than $15 by the end of 2016. New York crude will reach $46 a barrel during the fourth quarter, while Brent in London will trade at $48 in the same period, the median of 17 estimates compiled by Bloomberg this year show. A global surplus that fueled oil’s decline to a 12-year low will shift to deficit as U.S. shale output falls, according to Goldman Sachs Group Inc.

Credit: http://www.bloomberg.com/

-

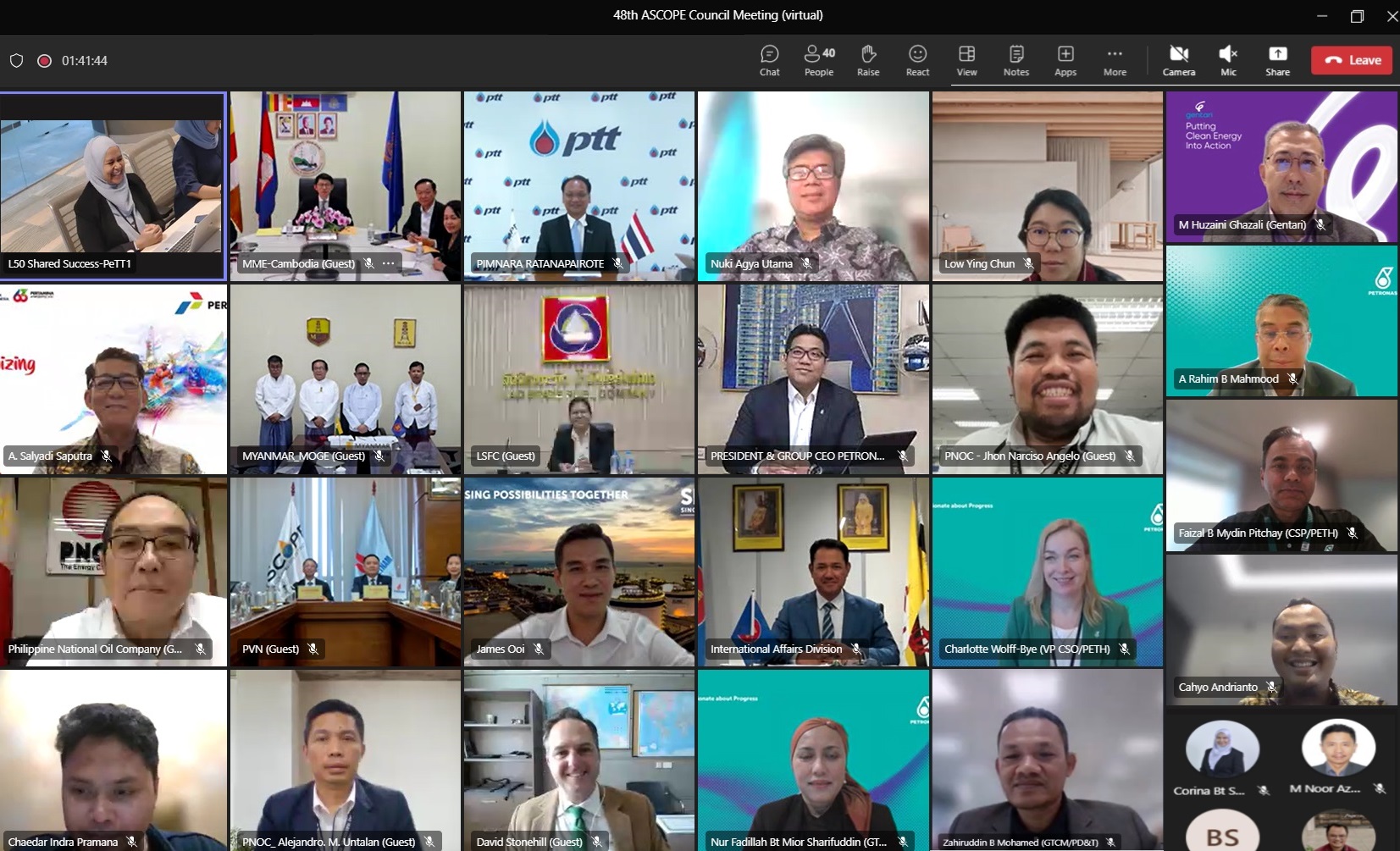

ASCOPE organised the 48th Council Meeting on 22nd November 2023 successfullyThe 48th ASCOPE Council Meeting hosted by Petroliam Nasional Berhad (Petronas) was held via online platform on 22nd November 2023.

ASCOPE organised the 48th Council Meeting on 22nd November 2023 successfullyThe 48th ASCOPE Council Meeting hosted by Petroliam Nasional Berhad (Petronas) was held via online platform on 22nd November 2023. -

ASCOPE participated in the 41st ASEAN Ministers on Energy MeetingFrom 24 to 25 August 2023, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 41st ASEAN Ministers on Energy Meeting and its associated meetings (41st AMEM) in Bali, Indonesia.

ASCOPE participated in the 41st ASEAN Ministers on Energy MeetingFrom 24 to 25 August 2023, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 41st ASEAN Ministers on Energy Meeting and its associated meetings (41st AMEM) in Bali, Indonesia. -

ASCOPE successfully organised the 7th Mid-Year Task Force MeetingGroup photo at the 7th ASCOPE Mid-Year Task Force meeting

ASCOPE successfully organised the 7th Mid-Year Task Force MeetingGroup photo at the 7th ASCOPE Mid-Year Task Force meeting -

ASCOPE organised the 47th Council Meeting on 21st November 2022 via online platform

ASCOPE organised the 47th Council Meeting on 21st November 2022 via online platformThe 47th ASCOPE Council Meeting hosted by Lao State Fuel Company (LSFC) in coordination with ASCOPE Secretariat was held virtually on 21st November 2022.

-

ASCOPE successfully organised the 6th Mid-Year Task Force MeetingThe 6th ASCOPE Mid-Year Task Force and its asscociated meetings hosted by PTT Public Company Limited (PTT) were successfully organised from 3rd - 5th August, 2022 in Bangkok, Thailand.

-

ASCOPE participated in Seminar on the Role of Natural Gas in Advancing a Low-Carbon Energy Transition in the ASEAN RegionOn 10th November, 2021, ASCOPE participated in the “Seminar on the Role of Natural Gas in Advancing a Low-Carbon Energy Transition in the ASEAN Region” which was virtually hosted by Ministry of Energy Brunei Darussalam and co-hosted by ASEAN Centre for Energy (ACE).

ASCOPE participated in Seminar on the Role of Natural Gas in Advancing a Low-Carbon Energy Transition in the ASEAN RegionOn 10th November, 2021, ASCOPE participated in the “Seminar on the Role of Natural Gas in Advancing a Low-Carbon Energy Transition in the ASEAN Region” which was virtually hosted by Ministry of Energy Brunei Darussalam and co-hosted by ASEAN Centre for Energy (ACE). -

ASCOPE organised the 46th Council Meeting on 25th October 2021 via online platform for the first time in historyThe 46th ASCOPE Council Meeting hosted by PT Pertamina in coordination with ASCOPE Secretariat was held virtually on 25th October 2021 for the first time since ASCOPE’s establishment in 1975.

ASCOPE organised the 46th Council Meeting on 25th October 2021 via online platform for the first time in historyThe 46th ASCOPE Council Meeting hosted by PT Pertamina in coordination with ASCOPE Secretariat was held virtually on 25th October 2021 for the first time since ASCOPE’s establishment in 1975. -

ASCOPE participated in the 39th ASEAN Ministers on Energy MeetingFrom 13 to 16 September 2021, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 39th ASEAN Ministers on Energy Meeting and its associated meetings (39th AMEM) via online platform chaired by the Ministry of Energy, Brunei Darussalam. With the theme “We Care, We Prepare, We Prosper”, it is expected that ASEAN Member States would continue to closely collaborate to foster ASEAN’s sustainable energy sector.

ASCOPE participated in the 39th ASEAN Ministers on Energy MeetingFrom 13 to 16 September 2021, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 39th ASEAN Ministers on Energy Meeting and its associated meetings (39th AMEM) via online platform chaired by the Ministry of Energy, Brunei Darussalam. With the theme “We Care, We Prepare, We Prosper”, it is expected that ASEAN Member States would continue to closely collaborate to foster ASEAN’s sustainable energy sector. -

ASCOPE organised the 5th Mid-Year Task Force Meeting on 30th June 2021The 5th ASCOPE Mid-Year Task Force Meeting held on 30th June 2021 via online platform was chaired by ASCOPE Secretary-In-Charge Dr. Tran Hong Nam with more than sixty (60) participants from all ASCOPE members in ASEAN countries.

ASCOPE organised the 5th Mid-Year Task Force Meeting on 30th June 2021The 5th ASCOPE Mid-Year Task Force Meeting held on 30th June 2021 via online platform was chaired by ASCOPE Secretary-In-Charge Dr. Tran Hong Nam with more than sixty (60) participants from all ASCOPE members in ASEAN countries. -

ASCOPE participated in the Special Senior Officials Meeting on EnergyOn 21st January 2021, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam on behalf of ten (10) national oil and gas companies/entities responsible for oil and gas in each of the ASEAN Member State (ASCOPE members) paticipated at the Special Senior Officials Meeting on Energy “Special SOME” via online platform hosted by Vietnam.

ASCOPE participated in the Special Senior Officials Meeting on EnergyOn 21st January 2021, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam on behalf of ten (10) national oil and gas companies/entities responsible for oil and gas in each of the ASEAN Member State (ASCOPE members) paticipated at the Special Senior Officials Meeting on Energy “Special SOME” via online platform hosted by Vietnam. -

ASCOPE participated in the 38th ASEAN Ministers on Energy MeetingFrom 17-20 November 2020, Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 38th ASEAN Ministers on Energy Meeting and Associated Meetings (38th AMEM) via online platform hosted by Viet Nam. With the theme “Energy transition towards sustainable development”, it is expected that ASEAN member states would closely cooperate together to build up a sustainable energy sector in ASEAN.

ASCOPE participated in the 38th ASEAN Ministers on Energy MeetingFrom 17-20 November 2020, Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 38th ASEAN Ministers on Energy Meeting and Associated Meetings (38th AMEM) via online platform hosted by Viet Nam. With the theme “Energy transition towards sustainable development”, it is expected that ASEAN member states would closely cooperate together to build up a sustainable energy sector in ASEAN. -

The 4th ASCOPE Mid-Year Task Force Meeting Held on 13th August 2020The 4th ASCOPE Mid-Year Task Force Meeting was held virtually for the first time on the 13th August 2020 due to Covid-19 pandemic situation. The meeting was chaired by Dr. Tran Hong Nam, ASCOPE Secretary-In-Charge and attended by ASCOPE Country Coordinators, Task Forces Chairpersons and Members.

The 4th ASCOPE Mid-Year Task Force Meeting Held on 13th August 2020The 4th ASCOPE Mid-Year Task Force Meeting was held virtually for the first time on the 13th August 2020 due to Covid-19 pandemic situation. The meeting was chaired by Dr. Tran Hong Nam, ASCOPE Secretary-In-Charge and attended by ASCOPE Country Coordinators, Task Forces Chairpersons and Members. -

Oil Capacity Building Program on Energy Security 2020 towards enhancing energy security in ASEAN regionDuring 17-20 February, 2020, ASCOPE’s Secretary- In- Charge Dr. Tran Hong Nam and his predecessor Mr. Nopporn Chuchinda participated in the Oil Capacity Building Program on Energy Security 2020 co-organized by Japan Oil, Gas and Metals National Corporation (JOGMEC) and ASEAN Centre for Energy (ACE) in association with Japan’s Agency for Natural Resources and Energy and the Ministry of Economy, Trade and Industry (MEITI).

Oil Capacity Building Program on Energy Security 2020 towards enhancing energy security in ASEAN regionDuring 17-20 February, 2020, ASCOPE’s Secretary- In- Charge Dr. Tran Hong Nam and his predecessor Mr. Nopporn Chuchinda participated in the Oil Capacity Building Program on Energy Security 2020 co-organized by Japan Oil, Gas and Metals National Corporation (JOGMEC) and ASEAN Centre for Energy (ACE) in association with Japan’s Agency for Natural Resources and Energy and the Ministry of Economy, Trade and Industry (MEITI). -

The 45th ASCOPE Council Meeting

The 45th ASCOPE Council Meeting -

Newsletter 2019_PRCBaa

Newsletter 2019_PRCBaa -

44th ASCOPE Council Meeting and Associated MeetingsDuring August 2018, the 44th ASCOPE Council Meeting and associated meetings were held in Thailand.

44th ASCOPE Council Meeting and Associated MeetingsDuring August 2018, the 44th ASCOPE Council Meeting and associated meetings were held in Thailand. -

THE 43rd ASCOPE Council Meeting and relating Taskforce Meetings.The 43rd ASCOPE Council Meeting, and relating Taskforce Meetings were held during 22-23 August 2017 in Singapore.

THE 43rd ASCOPE Council Meeting and relating Taskforce Meetings.The 43rd ASCOPE Council Meeting, and relating Taskforce Meetings were held during 22-23 August 2017 in Singapore. -

THE 42nd ASCOPE COUNCIL MEETING AND THE 82nd ASCOPE NATIONAL COMMITTEE CHAIRPERSON MEETINGTwo of the ASCOPE’s major events, The 42nd ASCOPE Council Meeting, and the 82nd ASCOPE National Committee Meeting were held during 6-9 September 2016 in Siem Reap, Cambodia.

THE 42nd ASCOPE COUNCIL MEETING AND THE 82nd ASCOPE NATIONAL COMMITTEE CHAIRPERSON MEETINGTwo of the ASCOPE’s major events, The 42nd ASCOPE Council Meeting, and the 82nd ASCOPE National Committee Meeting were held during 6-9 September 2016 in Siem Reap, Cambodia. -

ASCOPE Major Event: The 27th ASCOPE Joint Committees and The 81st ASCOPE National Committee Chairpersons MeetingASCOPE Major Event: The 27th ASCOPE Joint Committees and The 81st ASCOPE National Committee Chairpersons Meeting

ASCOPE Major Event: The 27th ASCOPE Joint Committees and The 81st ASCOPE National Committee Chairpersons MeetingASCOPE Major Event: The 27th ASCOPE Joint Committees and The 81st ASCOPE National Committee Chairpersons Meeting -

ADG Book is now available for sale online!What is ADG Book?

ADG Book is now available for sale online!What is ADG Book? -

Obama to seek new tax on oil in budget proposalWASHINGTON: U.S. President Barack Obama will launch a long-shot bid next week to impose a $10-a-barrel tax on crude oil that would fund the overhaul of the nation's aging transportation infrastructure, the White House said on Thursday.

Obama to seek new tax on oil in budget proposalWASHINGTON: U.S. President Barack Obama will launch a long-shot bid next week to impose a $10-a-barrel tax on crude oil that would fund the overhaul of the nation's aging transportation infrastructure, the White House said on Thursday. -

Oil prices steady, weak fundamentals weigh after volatile weekCrude oil futures steadied on Friday after earlier losses, as bearish fundamentals weighed on markets at the end of a volatile week that saw prices seesaw over 10 percent within a day.

Oil prices steady, weak fundamentals weigh after volatile weekCrude oil futures steadied on Friday after earlier losses, as bearish fundamentals weighed on markets at the end of a volatile week that saw prices seesaw over 10 percent within a day. -

Asian stock markets mostly lower as oil extends fallSEOUL, South Korea (AP) — Asian stock markets were mostly lower Tuesday as the price of oil extended losses following a 6-percent plunge that was sparked by data showing a manufacturing slowdown in the world's two largest economies.

Asian stock markets mostly lower as oil extends fallSEOUL, South Korea (AP) — Asian stock markets were mostly lower Tuesday as the price of oil extended losses following a 6-percent plunge that was sparked by data showing a manufacturing slowdown in the world's two largest economies. -

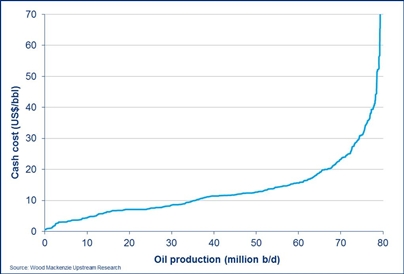

How Much Global Oil Output Halted Due to Low Prices? Just 0.1%After a year of low oil prices, only 0.1 percent of global production has been curtailed because it’s unprofitable, according to a report from consultants Wood Mackenzie Ltd. that highlights the industry’s resilience.

How Much Global Oil Output Halted Due to Low Prices? Just 0.1%After a year of low oil prices, only 0.1 percent of global production has been curtailed because it’s unprofitable, according to a report from consultants Wood Mackenzie Ltd. that highlights the industry’s resilience. -

Obama $10-Per-Barrel Oil Tax Lands With Thud in CongressPresident Barack Obama will propose a $10 per barrel tax on oil in his fiscal 2017 budget plan, an idea that received a chilly reception in the Republican-controlled Congress that oversees spending.

Obama $10-Per-Barrel Oil Tax Lands With Thud in CongressPresident Barack Obama will propose a $10 per barrel tax on oil in his fiscal 2017 budget plan, an idea that received a chilly reception in the Republican-controlled Congress that oversees spending. -

ASCOPE NewslettersHappyNewYear 2016 to all ASCOPE family members!

ASCOPE NewslettersHappyNewYear 2016 to all ASCOPE family members! -

PETROLEUM EXPLORATION READY TO ROLLThailand is likely to start its 21st round of petroleum exploration this year, expecting to grant licences to upstream petroleum investors by next month, says the Mineral Fuels Department.

PETROLEUM EXPLORATION READY TO ROLLThailand is likely to start its 21st round of petroleum exploration this year, expecting to grant licences to upstream petroleum investors by next month, says the Mineral Fuels Department.